As filed with the Securities and Exchange Commission on September 4, 2008August 21, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

GLOBAL PAYMENTS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

GLOBAL PAYMENTS INC.

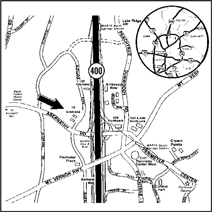

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

NOTICE OF 20082009 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders:

The 20082009 annual meeting of shareholders (the “Annual Meeting”) of Global Payments Inc. (the “Company”) will be held at our offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 26, 2008,30, 2009, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class |

| 2. | To ratify the reappointment of Deloitte & Touche LLP as the Company’s independent public accountants; |

| 3. | To approve a list of qualified business criteria for performance-based awards to be granted under the Global Payments Inc. Third Amended and Restated 2005 Incentive Plan (the “2005 Plan”); and |

| To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on August 22, 20087, 2009 are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. You may vote your shares by completing and returning the enclosed proxy card, or you may vote via the Internet or by telephone. Instructions for voting via the Internet or by telephone, are set forthas instructed in the enclosedNotice of Electronic Availability of Proxy Materials, or if you received your proxy statement and proxy card.materials by mail, you may also vote by mail.

YOUR VOTE IS IMPORTANT

Submitting your proxy does not affect your right to vote in person if you attend the Annual Meeting. Instead, it benefits us by reducing the expenses of additional proxy solicitation. Therefore, you are urged to submit your proxy as soon as possible, regardless of whether or not you expect to attend the Annual Meeting. You may revoke your proxy at any time before its exercise by (i) delivering written notice of revocation to our Corporate Secretary, Suellyn P. Tornay, at the above address, (ii) submitting to us a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 1:00 a.m., Central Time, on September 26, 2008.30, 2009.

When you submit your proxy, you authorize Paul R. Garcia or Suellyn P. Tornay or either one of them, each with full power of substitution, to vote your shares at the Annual Meeting in accordance with your instructions or, if no instructions are given, for the election of the Class IIIII nominees, and for the ratification of the reappointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent public accountants.accountants and for the approval of the list of qualified business criteria for performance-based awards to be granted under the 2005 Plan. The proxies, in their discretion, are further authorized to vote on any adjournments or postponements of the Annual Meeting, for the election of one or more persons to the Board of Directors if any of the nominees becomes unable to serve or for good cause will not serve, on matters which the Board does not know a reasonable time before making the proxy solicitations will be presented at the Annual Meeting, or any other matters which may properly come before the Annual Meeting and any postponements or adjournments thereto.

By Order of the Board of Directors,

|

SUELLYN P. TORNAY, Executive Vice President, General Counsel and Corporate Secretary |

Dated: September 4, 2008August 21, 2009

September 4, 2008August 21, 2009

GLOBAL PAYMENTS INC.

10 GLENLAKE PARKWAY, NORTH TOWER

ATLANTA, GEORGIA 30328

PROXY STATEMENT

| A. | Introduction |

This Proxy Statement is being furnished to solicit proxies on behalf of the Board of Directors of Global Payments Inc. (the “Company” or “we”) for use at the 20082009 annual meeting of shareholders (the “Annual Meeting”), and at any adjournments or postponements thereof. The Annual Meeting will be held at our offices at 10 Glenlake Parkway, North Tower, Atlanta, Georgia, 30328-3473 on September 26, 2008,30, 2009, at 11:00 a.m., Atlanta time, for the following purposes:

| 1. | To elect three Class |

| 2. | To ratify the reappointment of Deloitte & Touche LLP as the Company’s independent public accountants, |

| 3. | To approve a list of qualified business criteria for performance-based awards to be granted under the Global Payments Inc. Third Amended and Restated 2005 Incentive Plan (the “2005 Plan”); and |

| To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

ThisNotice of Electronic Availability of Proxy Statement and Annual Report. As permitted by the accompanyingSecurities and Exchange Commission rules, we are making this proxy cardstatement and our annual report available to our shareholders electronically via the Internet. The notice of electronic availability contains instructions on how to access this proxy statement and our annual report and vote online. You will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your proxy over the Internet or by telephone. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the notice.

The Notice of Electronic Availability of Proxy Materials and this Proxy Statement are first being mailed to shareholders on or about September 4, 2008.August 21, 2009.

| B. | Quorum and Voting |

(1) Voting Shares.Pursuant to our Amended and Restated Articles of Incorporation, only the Company’s common shares, no par value (the “Common Stock”), may be voted at the Annual Meeting.

(2) Record Date.Only those holders of Common Stock of record at the close of business on August 22, 2008,7, 2009, are entitled to receive notice and to vote at the Annual Meeting or any adjournment or postponement thereof. On that date, there were 79,788,99980,653,542 shares of Common Stock issued and outstanding, held by approximately 2,4612,493 shareholders of record. These holders are entitled to one vote per share.

1

(3) Quorum.In order for any business to be conducted, the holders of a majority of the shares entitled to vote at the Annual Meeting must be present (a “Quorum”), either in person or represented by proxy. Abstentions and votes withheld, and shares represented by proxies reflecting abstentions or votes withheld, will be treated as present for purposes of determining the existence of a Quorum at the Annual Meeting. They will not be considered as votes “for” or “against” any matter for which the respective shareholders have indicated their intention to abstain or withhold their votes. Broker or nominee non-votes, which occur when shares held in “street name” by brokers or nominees who indicate that they do not have discretionary authority to vote on a particular matter, will not be considered as votes “for” or “against” that particular matter. Broker and nominee non-votes will be treated as present for purposes of determining the existence of a Quorum and may be entitled to vote on other matters at the Annual Meeting.

1

(4) Voting Options. The first proposal, which is the election of three directors in Class II,III, will require the vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a Quorum is present. Shareholders may (i) vote “for” each nominee, or (ii) “withhold” authority to vote for any nominee. If a Quorum is present, a vote to “withhold” and a broker non-vote will have no effect on the outcome of the election of directors. The three nominees receiving the most votes will be elected to serve as the Class IIIII Directors for a three-year term.

With respect to the second proposal, the ratification of the reappointment of Deloitte as the Company’s independent public accountants, shareholders may (i) vote “for,” (ii) vote “against,” or (iii) “abstain” from voting on the proposal. An abstention will have the same effect as a vote “against,” while a broker non-vote will have no effect on the outcome of the reappointment of Deloitte as the Company’s independent public accountants.

With respect to the third proposal, the approval of a list of qualified business criteria for performance-based awards to be granted under the Global Payments Inc. Third Amended and Restated 2005 Incentive Plan (the “2005 Plan”) in order to preserve federal income tax deductions, shareholders may (i) vote “for,” (ii) vote “against,” or (iii) “abstain” from voting on the proposal. An abstention will have the same effect as a vote “against,” while a broker non-vote will have no effect on the outcome of the approval.

(5) How to VoteIf you received a notice of electronic availability, you cannot vote your shares by filling out and returning the notice. The notice, however, provides instructions on how to vote by Internet, by telephone or by requesting and returning a paper proxy card.

Internet and Telephone Voting. Shareholders of record can simplify their voting and reduce our costs by voting their shares via the Internet or by telephone. Shareholders may submit their proxy voting instructions via the Internet or telephone by accessingfollowing the website identified oninstructions provided in the enclosed proxy card and following instructions on the website. Shareholders who choose to submit their proxy voting instructions by telephone should call the phone number identified on the enclosed proxy card and follow the prompts.notice of electronic availability. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, to allow shareholders to vote their shares, and to confirm that their instructions have been properly recorded. If your shares are held in the name of a bank or broker, the availability of Internet and telephone voting will depend on the voting processes of the applicable bank or broker; therefore, it is recommended that you follow the voting instructions on the form you receive. If you do not choose toreceived a printed version of the proxy materials by mail, you may vote viaby following the Internet or by telephone, please date, sign,instructions provided with your proxy materials and return theon your proxy card.

(6) Default Voting.When a proxy is timely executed and not revoked, the shares represented by the proxy will be voted in accordance with the instructions indicated in the proxy. IF NO INSTRUCTIONS ARE INDICATED, HOWEVER, PROXIES WILL BE VOTED “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED IN PROPOSAL 1, AND “FOR” PROPOSAL 2 RELATING TO THE RATIFICATION OF THE REAPPOINTMENT OF DELOITTE AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS.ACCOUNTANTS, AND “FOR” PROPOSAL 3 RELATING TO THE APPROVAL OF A LIST OF QUALIFIED BUSINESS CRITERIA FOR PERFORMANCE-BASED AWARDS TO BE GRANTED UNDER THE GLOBAL PAYMENTS INC. THIRD AMENDED AND RESTATED 2005 INCENTIVE PLAN.

2

The Board of Directors is not presently aware of any business to be presented for a vote at the Annual Meeting other than the proposals noted above. If any other matter properly comes before the meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is made, in their own discretion.

(7) Revocation of a Proxy.A shareholder’s submission of a proxy via the Internet, by telephone, or by mail does not affect the shareholder’s right to attend in person. A shareholder who has given a proxy may revoke it at any time prior to its being voted at the Annual Meeting by (i) delivering written notice of revocation to our Corporate Secretary, Suellyn P. Tornay, at our address listed on the first page of this proxy statement, (ii) properly submitting to us a duly executed proxy card bearing a later date, (iii) voting via the Internet or by telephone at a later date, or (iv) appearing at the Annual Meeting and voting in person; provided, however, that no such revocation under clause (i) or (ii) shall be effective until written notice of revocation or a later dated proxy card is received by the Corporate Secretary at or before the Annual Meeting, and no such revocation under clause (iii) shall be effective unless received on or before 1:00 a.m. Central Time on September 26, 2008.30, 2009.

(8) Adjourned Meeting.If a Quorum is not present, the Annual Meeting may be adjourned by the holders of a majority of the shares of Common Stock represented at the Annual Meeting. The Annual Meeting may be rescheduled at the time of the adjournment with no further notice of the reconvened meeting if the date, time and place of the reconvened meeting are announced at the adjourned meeting before its adjournment; provided, however, that if a new record date is or must be fixed, notice of the reconvened meeting must be given to the shareholders of record as of the new record date. An adjournment will have no effect on the business to be conducted at the meeting.

PROPOSAL ONE:

2

ELECTION OF DIRECTORS; NOMINEES

Our Bylaws provide that the number of directors constituting the Board of Directors shall be not less than two nor more than twelve, as determined from time to time by resolution of the shareholders or of the Board of Directors. Our Board of Directors has adopted a resolution that the Board should have nine members. The Board of Directors currently consists of nine members, who are divided into three classes, with the term of office of each class ending in successive years. Each class of directors serves staggered three-year terms.

The three directors in Class II, Paul R. Garcia, Gerald J. Wilkins, and MichaelIII, Alex W. Trapp,Hart, William I Jacobs, Alan M. Silberstein, have been nominated for election at the Annual Meeting. The Class IIIII Directors will be elected to hold office until the 20112012 annual meeting of shareholders, or until their respective successors have been duly elected and qualified, or until their respective earlier resignation, retirement, disqualification, removal from office or death. In the event that any of the nominees is unable to serve (which is not anticipated), the persons designated as proxies will cast votes for such other person(s) as they may select.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES FOR DIRECTOR.

The affirmative vote of the holders of a plurality of the shares of Common Stock represented and entitled to vote at the Annual Meeting at which a quorum is present is required for the election of each of the nominees. If a choice is specified on the proxy card by a shareholder, the shares will be voted as specified. If no specification is made, the shares will be voted “FOR” each of the three nominees.

3

| A. | Certain Information Concerning the Nominees and Directors |

The following table sets forth the names of the nominees and the directors continuing in office, their ages, the month and year in which they first became directors of the Company, their positions with the Company, their principal occupations and employers for at least the past five years, any other directorships held by them in companies that are subject to the reporting requirements of the Securities Exchange Act of 1934 or any company registered as an investment company under the Investment Company Act of 1940, as well as additional information. There is no family relationship between any of our executive officers or directors. There are no arrangements or understandings between any of our directors and any other person pursuant to which any of them was elected as a director, other than arrangements or understandings with the directors solely in their capacities as such. For information concerning membership on committees of the Board of Directors, see “Other Information about the Board and its Committees” below.

NOMINEES FOR DIRECTOR

Class IIIII

Term Expiring Annual Meeting 20112012

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

| ||

|

| |

|

| |

4

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class I

Term Expiring Annual Meeting 2010

|

| |

|

| |

|

| |

|

| |

5

Class III

Term Expiring Annual Meeting 2009

|

| |

Alex W. Hart

| Director of the Company (since February 2001) Business Consultant (since October 1997); Chief Executive Officer of Advanta Corporation (1995-1997); Executive Vice Chairman of Advanta Corporation (1994); President and Chief Executive Officer of MasterCard International (1988-1994); Director, Fair Isaac Corporation and VeriFone, Inc.; Chairman of the Board and Director, Silicon Valley Bancshares. | |

William I Jacobs

| Director of the Company (since February 2001) Business Advisor (since August 2002); Managing Director and Chief Financial Officer of The New Power Company (2000-2002) (1); Senior Executive Vice President, Strategic Ventures for MasterCard International (1999-2000); Executive Vice President, Global Resources for MasterCard International (1995-1999); Executive Vice President, Chief Operating Officer, Financial Security Assurance, Inc. (1984-1994); Director, Asset Acceptance Capital Corp. | |

Alan M. Silberstein

| Director of the Company (since September 2003) President, Allston Associates LLP (previously Silco Associates Inc.) (since October 2004) (2); President and Chief Operating Officer, Debt Resolve, Inc. (2003-2004) (3); President and Chief Executive Officer, Western Union (2000-2001); Chairman and Chief Executive Officer, Claim Services, Travelers Property Casualty Insurance (1996-1997); Executive Vice President, Retail Banking, Midlantic Corporation (1992-1995); Director, Capital Access Network, Inc. | |

| (1) | National residential and small business energy provider. |

| (2) | Management services firm. |

| (3) | Provider of online collections services. |

64

MEMBERS OF THE BOARD OF DIRECTORS CONTINUING IN OFFICE

Class I

Term Expiring Annual Meeting 2010

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

Edwin H. Burba, Jr. (72) | Director of the Company (since February 2001) National Security Leadership and Business Consultant (since 1993); Commander in Chief, Forces Command, United States Army (1989-1993); Commanding General, Combined Field Army of the Republic of Korea and United States (1988-1989). | |

Raymond L. Killian (72) | Director of the Company (since September 2003) Chairman Emeritus, Investment Technology Group, Inc. (since March 2007) (1); Chairman, Investment Technology Group, Inc. (1997-2007); President and Chief Executive Officer, Investment Technology Group, Inc. (1995-2002 and 2004-2007); Executive Vice President, Jefferies Group, Inc. (1985-1995); Vice President, Institutional Sales, Goldman Sachs & Co. (1982-1985). | |

Ruth Ann Marshall (55) | Director of the Company (since September 2006) President, Americas for MasterCard International (2000-2006) (2); Senior Executive Vice President, Concord, EFS (1995-1999); Director, Pella Corporation and ConAgra, Inc. | |

| (1) | Specialized agency brokerage and technology firm. |

| (2) | A global payment solutions company. |

Class II

Term Expiring Annual Meeting 2011

Name and Age | Month and Year First Became Director, Positions with the Company, Principal Occupations During at Least the Past Five Years, and Other Directorships | |

Paul R. Garcia (57) | Chairman of the Board of the Company (since October 2002); Director and Chief Executive Officer of the Company (since February 2001); Chief Executive Officer of NDC eCommerce, a division of National Data Corporation (July 1999 - January 2001); President and Chief Executive Officer of Productivity Point International (March 1997 – September 1998); Group President of First Data Card Services (1995 – 1997); Chief Executive Officer of National Bancard Corporation (NaBANCO) (1989 – 1995). | |

Gerald J. Wilkins (51) | Director of the Company (since November 2002) Chief Financial Officer, Habitat for Humanity International (2007-2008) (1); President, WJG Consulting, Inc. (2003-2007) (2); Executive Vice President and Chief Financial Officer of AFC Enterprises, Inc. (2000-2003) (3); Chief Financial Officer of AFC Enterprises, Inc. (1995-2000); Vice President, International Business Planning, KFC International (1993-1995). | |

Michael W. Trapp (69) | Director of the Company (since July 2003) President, Sands Partners, Inc. (since 2000) (4); Managing Partner, Southeast area, Ernst & Young LLP (1993-2000); Director, The Ann Taylor Stores Corporation. | |

| (1) | Nonprofit housing ministry. |

| (2) | Independent consulting firm. |

| (3) | Franchisor and operator of quick-service restaurants. |

| (4) | Investment business. |

5

| B. | Other Information about the Board and its Committees |

(1) Meetings. During the fiscal year ended May 31, 20082009 (the 20082009 fiscal year), our Board of Directors held ninesix meetings. All directors attended 75% or more of the combined total of the Board of Directors meetings and meetings of the committees on which they served during the period for which the respective director served on the Board of Directors or the applicable committee.

(2) Fiscal Year 20082009 Director Compensation. The following table reflects the compensation payable to the outside directors of the Company. Since we do not offer any non-equity incentive plan compensation or any pension benefits to our directors, and there was no other compensation required to be disclosed, columns (e), (f), and (g) have been eliminated.

DIRECTOR COMPENSATION

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($)(2) | Total | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($)(2) | Total | ||||||||||||||||

| (a) | (b) | (c) | (d) | (h) | (b) | (c) | (d) | (h) | ||||||||||||||||

Edwin H. Burba | $ | 66,500 | $ | 45,018 | $ | 49,863 | $ | 161,381 | $ | 67,500 | $ | 45,006 | $ | 56,199 | $ | 168,705 | ||||||||

Paul R. Garcia (3) | — | — | — | — | — | — | — | — | ||||||||||||||||

Alex W. Hart | $ | 65,500 | $ | 45,018 | $ | 49,863 | $ | 160,381 | $ | 67,500 | $ | 45,006 | $ | 56,199 | $ | 168,705 | ||||||||

William I Jacobs | $ | 94,500 | $ | 69,995 | $ | 49,863 | $ | 214,358 | $ | 94,500 | $ | 70,004 | $ | 56,199 | $ | 220,703 | ||||||||

Raymond L. Killian | $ | 69,500 | $ | 45,018 | $ | 48,451 | $ | 162,969 | $ | 72,000 | $ | 45,006 | $ | 56,199 | $ | 173,205 | ||||||||

Ruth Ann Marshall | $ | 56,500 | $ | 45,018 | $ | 28,476 | $ | 129,994 | $ | 55,500 | $ | 45,006 | $ | 48,472 | $ | 148,978 | ||||||||

Alan M. Silberstein | $ | 65,000 | $ | 45,018 | $ | 48,451 | $ | 158,469 | $ | 64,500 | $ | 45,006 | $ | 56,199 | $ | 165,705 | ||||||||

Michael W. Trapp | $ | 75,000 | $ | 45,018 | $ | 48,507 | $ | 168,525 | $ | 73,000 | $ | 45,006 | $ | 56,199 | $ | 174,205 | ||||||||

Gerald J. Wilkins | $ | 62,000 | $ | 45,018 | $ | 48,875 | $ | 155,893 | $ | 60,000 | $ | 45,006 | $ | 56,199 | $ | 161,205 | ||||||||

| (1) | The amount shown in this column is the number of shares received multiplied by the value of the stock on the date of the grant. Additional details are set forth in the section entitled “Compensation Policy” below. Such shares are entitled to receive dividends once issued but at the same rate as all of the Company’s shareholders. |

| (2) | The amounts shown in this column reflect stock option awards granted in fiscal year |

| (3) | Mr. Garcia is a member of the Board of Directors and is also an employee of the Company and does not receive any additional compensation for his role as a director. |

(3) Compensation Policy.We have a policy regarding the compensation of directors, which provides that a non-employee director who serves as the lead director is compensated at a rate of $75,000 per year in cash and receives shares of the Company’s stock worth approximately $70,000. A non-employee director who serves as the chairperson of the audit committee receives $55,000 in cash and stock worth approximately $45,000. A non-employee director who serves as a chairperson of any other committee receives $50,000 in cash and stock worth approximately $45,000. Each other non-employee director receives an annual retainer of $45,000 in cash and shares of stock worth approximately $45,000. All Company stock issued pursuant to the director compensation policy is valued at the then-prevailing market price and is issued under our Amended and Restated 2005 Incentive Plan. Pursuant to the foregoing policy, Mr. Jacobs received 1,645 1,599

6

shares of stock, and each of the other non-employee directors received 1,0581,028 shares of stock. Such stock is

7

issued and cash is paid on the business day following each annual meeting of shareholders. By paying part of the annual consideration in stock, we believe that this encourages ownership of our stock by our directors.

In addition, all non-employee directors received $1,500 per Board meeting attended, except for the lead director who received $2,500 per Board meeting. Non-employee directors who served on a committee received $1,500 per committee meeting, while the chairperson of such committee received $2,500 per committee meeting. Telephonic meetings and telephonic participation are compensated at $1,000 per meeting. We do not compensate a director who is also an employee of the Company for his or her services as a director. Directors were also compensated for their out-of-pocket expenses incurred in connection with attendance at Board and committee meetings. The spouses of the Board members were invited to attend one of the meetings held in Atlanta and we paid or reimbursed the directors for the applicable out-of-pocket expenses incurred.

(4) Amended and Restated 2000 Non-Employee Director Stock Option Plan. We maintain the Amended and Restated 2000 Non-Employee Director Stock Option Plan (the “2000 Director Plan”), which provides for the grant to each of our non-employee directors of an option to purchase shares of Common Stock having a valuation according to the Black-Scholes option pricing model of $80,000. The purpose of the 2000 Director Plan is to advance the interests of the Company by encouraging ownership of our Common Stock by non-employee directors, thereby giving such directors an increased incentive to devote their efforts to our success. The options are granted to non-employee directors upon election or appointment to the Board and on the business day following each annual meeting of shareholders. Option grants under the 2000 Director Plan are pro-rated for partial years of service. All options granted in fiscal year 20082009 under the 2000 Director Plan will become exercisable as to 25% of the shares after the first year, 25% after the second year, 25% after the third year, and 25% after the fourth year of service from the grant date, except that such options will become fully exercisable upon the death, disability or retirement of the grantee, or upon the grantee’s failure to be re-nominated or re-elected as a director. Upon a grantee’s termination as a director for any reason, the options held by such person under the 2000 Director Plan will remain exercisable for five years or until the earlier expiration of the option. The exercise price for each option granted under the 2000 Director Plan will be the fair market value of the shares of Common Stock subject to the option on the date of the grant. Each option granted under the 2000 Director Plan will, to the extent not previously exercised, terminate and expire on the date which is 10 years after the grant date of the option unless the 2000 Director Plan provides for earlier termination.During the fiscal year ended May 31, 2008,2009, the eight non-employee directors received a stock option grant for the purchase of 5,4026,250 shares of the Company’s Common Stock at an exercise price of $42.55$43.78 per share.

(5) Outstanding Options for Directors.The following table reflects the outstanding options (vested and unvested) for each non-employee director as of May 31, 2008.2009. The value is calculated by multiplying the number of options outstanding by the difference between the value of our stock on the first business day after May 31, 2008,2009, which was $46.46,$36.61, and the exercise price of the option.

Non-employee | Options Outstanding as of May 31, 2008 (includes vested and unvested) | Value as of the first business day following May 31, 2008 (includes vested and unvested) | |||

Edwin H. Burba | 55,062 | $ | 1,381,058 | ||

Alex W. Hart | 39,322 | $ | 830,987 | ||

William I Jacobs | 55,062 | $ | 1,381,058 | ||

Raymond L. Killian | 25,940 | $ | 403,062 | ||

Ruth Ann Marshall | 9,772 | $ | 53,984 | ||

Alan M. Silberstein | 25,940 | $ | 403,062 | ||

Michael W. Trapp | 27,166 | $ | 439,198 | ||

Gerald J. Wilkins | 28,064 | $ | 470,499 | ||

8

Non-employee Directors | Options Outstanding as of May 31, 2009 (includes vested and unvested) | Value as of the first business day following May 31, 2009 (includes vested and unvested) | |||

Edwin H. Burba | 61,312 | $ | 880,967 | ||

Alex W. Hart | 45,572 | $ | 485,935 | ||

William I Jacobs | 61,312 | $ | 880,967 | ||

Raymond L. Killian | 32,190 | $ | 189,823 | ||

Ruth Ann Marshall | 16,022 | $ | 0 | ||

Alan M. Silberstein | 32,190 | $ | 189,823 | ||

Michael W. Trapp | 33,416 | $ | 213,883 | ||

Gerald J. Wilkins | 29,730 | $ | 147,376 | ||

(6) Lead Director. The lead director’s duties generally include serving as the chairperson for all executive sessions of the non-management directors and communicating to the Chief Executive Officer the

7

results of non-management executive Board sessions. Mr. Jacobs serves as our lead director. Any interested party may contact the lead director by directing such communications to him at our address (10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by us will be forwarded to Mr. Jacobs.

(7) Director Independence. Each year the Board of Directors undertakes a review of director independence based on the standards for director independence included in the New York Stock Exchange corporate governance rules. The Board considers whether or not there existed any relationships and transactions during the past three years between each director or any member of his or her immediate family, on the one hand, and the Company and its subsidiaries and affiliates, on the other hand. The purpose of the review was to determine whether or not any such relationships and transactions existed and, if so, whether any such relationships or transactions were inconsistent with a determination that the director is independent. In fiscal year 2008,2009, there were no such relationships or transactions between the non-employee directors and the Company to review and, as a result, the Board of Directors has determined that all of the directors, except Mr. Garcia (who serves as the Company’s President and Chief Executive Officer), are independent of the Company and its management.

(8) Committees. Our Board of Directors has a separately-designated Audit Committee, a Compensation Committee, and a Governance and Nominating Committee, and a Technology Committee. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Board of Directors has determined that all members of the threefour committees satisfy the independence requirements of the SEC and the New York Stock Exchange. Each of the committee charters and our corporate governance guidelines are available on our website (www.globalpaymentsinc.com), and will be provided free of charge, upon written request of any shareholder addressed to Global Payments Inc., 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3473, Attention: Investor Relations. Certain information regarding the functions of the Board’s committees and their present membership is provided below. In addition, the Board of Directors also maintains a Technology Committee.

(9) Audit Committee. As of the end of fiscal year 2008,2009, the members of the Audit Committee were Mr. Trapp (Chairperson), Mr. Wilkins, and Mr. Silberstein. The Audit Committee operates under a written charter adopted by the Board of Directors which is available on our website (www.globalpaymentsinc.com). The Audit Committee annually reviews a report by the independent auditors describing the firm’s internal quality control procedures; reviews the scope, plan and results of the annual audit of the financial statements by our independent auditors; reviews the scope, plan and results of the internal audit program; reviews the nature and extent of non-audit professional services performed by the independent auditors; and annually recommends to the Board of Directors the firm of independent public accountants to be selected as our independent auditors for the next fiscal year. During fiscal year 2008,2009, the Audit Committee held four meetings, each of which was separate from a regular Board meeting.

(10) Audit Committee Financial Expert. The Board of Directors has determined that the chairman of the Audit Committee, Mr. Trapp, is an audit committee financial expert and is independent as independence for audit committee members is defined under the rules established by the SEC and the New York Stock Exchange.

(11) Compensation Committee. As of the end of fiscal year 2008,2009, the members of the Compensation Committee were General Burba (Chairperson), Mr. Hart, Mr. Jacobs, Mr. Killian and Mr. Killian.Ms. Marshall. The Committee operates under a written charter which is available on our website (www.globalpaymentsinc.com). This committee reviews levels of compensation, benefits, and performance criteria for our executive officers and administers the Amended and Restated 2000 Long Term Incentive Plan, the 2000 Employee Stock Purchase Plan, the 2000 Director Plan, and the Amended and Restated 2005 Incentive Plan. The Compensation Committee charter allows the Committee to delegate certain matters within its authority to individuals, and the Committee may form and delegate authority to subcommittees as appropriate. In addition, the Committee has the authority under its charter to retain outside advisors to assist the Committee in the performance of its duties, and for fiscal year 20082009 the Committee retained the services of Hewitt Associates, an independent

9

compensation consulting firm. The Compensation Discussion and Analysis section of this proxy statement describes our processes and procedures for the consideration and determination of executive

8

compensation, including the role of the executive officers in determining compensation, and describes the role of Hewitt in more detail.

During fiscal year 2007, the Compensation Committee also hired Hewitt to assist with a review of the director compensation. The Compensation Committee, with Hewitt’s assistance, made recommendations to the full Board, which waswere approved on July 24, 2007 and which took effect on September 27, 2007 and will remain in effect for three years. The executives have no role in determining Board compensation. During fiscal year 2008,2009, the Compensation Committee held twofour meetings, bothall of which were separate from regular Board meetings.

(12) Compensation Committee Interlocks and Insider Participation. None of the members of the Compensation Committee has ever served as an officer or an employee of the Company or any of its subsidiaries and has never had any relationship requiring disclosure by the Company under Item 404 of Regulation S-K.

(13) Governance and Nominating Committee. As of the end of fiscal year 2008,2009, the members of the Governance and Nominating Committee were Mr. Hart (Chairperson), General Burba, Mr. Jacobs, and Ms. Marshall. The Committee operates under a formal charter which is available on our website (www.globalpaymentsinc.com). This committee is responsible for developing and recommending to the Board of Directors a set of corporate governance principles applicable to us, determining the structure of the Board and its committees, and for identifying, nominating, proposing, and qualifying nominees for open seats on the Board of Directors, based primarily on the following criteria:

Experience as a member of senior management or director of a significant business corporation, educational institution, or not-for-profit organization;

Particular skills or experience that enhances the overall composition of the Board of Directors;

Serves on no more than five other publicly-held corporation boards of directors; and

Serves on no more than three other audit committees of boards of directors of publicly-held corporations.

In evaluating nominees, the Committee will also take into account the consideration that members of the Board of Directors should collectively possess a broad range of skills, expertise, industry knowledge and other knowledge, business experience and other experience useful to the effective oversight of our business.

The Governance and Nominating Committee does not consider or accept nominees to the Board of Directors nominated by shareholders. The Governance and Nominating Committee considers candidates for director who are recommended by other members of the Board of Directors and by management, as well as those identified by any outside consultants retained by the committee to assist in identifying possible candidates.

Members of the Governance and Nominating Committee must discuss and evaluate possible candidates prior to recommending them to the Board. This committee had noone formal meetingsmeeting during fiscal year 2008.2009.

(14) Technology Committee. As of the end of fiscal year 2009, the members of the Technology Committee were Mr. Killian (Chairperson), Mr. Hart, and Mr. Silberstein. The Committee operates under a formal charter which is available on our website (www.globalpaymentsinc.com). This committee is to serve as a liaison between the Board and management with regard to matters related to information technology and information security and to review the practices and key initiatives of the Company related to information technology and information security. During fiscal year 2009, the Technology Committee held two meetings, both of which were separate from regular Board meetings.

(15) Communications from Security Holders. Any security holder may contact any member of the Board of Directors by directing such communication to such Board member at our address (10 Glenlake

9

Parkway, North Tower, Atlanta, Georgia 30328-3473). Any such correspondence received by us shall be forwarded to the applicable Board member.

(15)(16) Attendance at Annual Meeting. All directors are expected to attend our annual meeting of shareholders. On the date of the fiscal year 20072008 annual shareholder meeting, there were nine members on our Board of Directors, and all nine members were present at the meeting.

PROPOSAL TWO:

10

RATIFICATION OF THE REAPPOINTMENT OF AUDITORS

| A. | Deloitte & Touche LLP |

The Audit Committee recommends, and the Board of Directors selects, independent public accountants for the Company. The Audit Committee has recommended that Deloitte & Touche LLP, or Deloitte, who served during the fiscal year ended May 31, 2008,2009, be selected for the fiscal year ending May 31, 2009,2010, and the Board has approved the selection. Unless a shareholder directs otherwise, proxies will be voted for the approval of the selection of Deloitte as independent public accountants for fiscal year ending May 31, 2009.2010. If the appointment of Deloitte is not ratified by the shareholders, the Board will consider the selection of other independent public accountants for 2009.2010.

A representative of Deloitte will be present at the 20082009 Annual Meeting. The representative will be given the opportunity to make a statement, if he or she desires to do so, and will be available to respond to appropriate questions from shareholders.

| B. | Audit Fees |

The aggregate fees billed by Deloitte for professional services rendered for the audit of our annual financial statements and the reviews of the financial statements included in our quarterly reports on Form 10-Q were $1,768,000 for fiscal year 2007 and $1,941,000 for fiscal year 2008.2008 and $2,622,000 for fiscal year 2009.

| C. | Audit-Related Fees |

Audit-related fees are the fees billed by Deloitte for professional services rendered for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements. The audit relatedaudit-related fees billed during fiscal year 20072008 were $141,000$82,000 and $82,000 forduring fiscal year 2008.2009 were $172,000. The fees paid in fiscal year 2007 were for services in connection with acquisition due diligence proceduresyears 2008 and consultation concerning our response to correspondence received from the SEC. The fees paid in fiscal year 20082009 were for services in connection with acquisition due diligence procedures and audits of financial statements included in certain Asia-Pacific jurisdiction tax returns, as required by local statute.

| D. | Tax Fees |

The aggregate fees billed by Deloitte for professional services rendered for tax compliance, tax advice, and tax planning services were $481,000 for fiscal year 2007 and $750,000 for fiscal year 2008. In2008 and $544,000 for fiscal year 2007, $243,000 of such fees were for tax return preparation and compliance and $238,000 were for tax consulting and advisory services.2009. In fiscal year 2008, $180,000 of such fees were for tax return preparation and compliance, and $570,000 were for tax consulting and advisory services. In fiscal year 2009, $107,000 of such fees were for tax return preparation and compliance and $437,000 were for tax consulting and advisory services.

| E. | All Other Fees. |

Except as described above, there were no other fees billed by Deloitte for professional services in fiscal year 20072008 or fiscal year 2008.2009.

| F. | Audit Committee Pre-Approval Policies |

The Audit Committee must approve any audit services and any permissible non-audit services provided by Deloitte prior to the commencement of the services. In making its pre-approval determination,

10

the Audit Committee considers whether providing the non-audit services is compatible with maintaining the auditor’s independence. To minimize relationships which could appear to impair the objectivity of the independent registered public accounting firm, it is the Audit Committee’s practice to restrict the non-audit services that may be provided to us by our independent auditor to audit-related services, tax services and merger and acquisition due diligence and integration services.

11

The Audit Committee has delegated to the Chair of the Audit Committee the authority to approve non-audit services by the independent registered public accounting firm within the guidelines set forth above, provided that the fees associated with the applicable engagement are not anticipated to exceed $100,000. Any decision by the Chair to pre-approve non-audit services must be presented to the full Audit Committee for ratification at its next scheduled meeting. All of the services described under the headings “Audit Fees,” “Audit-Related Fees,” “Tax Fees”,Fees,” and “All Other Fees” were approved by the Audit Committee in accordance with the foregoing policy.

| G. | Audit Committee Review |

Our Audit Committee has reviewed the services rendered and the fees billed by Deloitte for the fiscal year ended May 31, 2008.2009. The Audit Committee has considered whether or not the provision of non-audit services described above under the headings “Audit-Related Fees” and “All Other Fees” is compatible with maintaining Deloitte’s independence and have determined that the provision of such services does not affect Deloitte’s independence.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE REAPPOINTMENT OF THE INDEPENDENT PUBLIC ACCOUNTANTS.

PROPOSAL THREE:

APPROVE QUALIFIED BUSINESS CRITERIA FOR PERFORMANCE-BASED AWARDS UNDER THE 2005 INCENTIVE PLAN

The Company currently maintains the Global Payments Inc. Third Amended and Restated 2005 Incentive Plan (the “2005 Plan”), which was originally approved by the shareholders on September 21, 2004, and has since been amended and restated three times by the Board of Directors. A copy of the 2005 Plan, as most recently amended and restated, is attached to this proxy statement as Exhibit A.

The 2005 Plan contains a list of business criteria (“Qualified Business Criteria”) with respect to which the Compensation Committee may establish objectively determinable performance goals for performance-based awards under the 2005 Plan that are fully deductible without regard to the $1,000,000 deduction limit imposed by Section 162(m) of the U.S. Internal Revenue Code of 1986 (the “Code”). In order to preserve the Company’s ability to continue to grant certain fully deductible performance-based awards, a list of Qualified Business Criteria must be approved by the shareholders no less often than every five years. The Board of Directors recommends that the shareholders re-approve at the annual meeting the list of Qualified Business Criteria for the 2005 Plan set out below under the caption “Performance Goals.”

As of July 24, 2009, there were approximately 1,360 of the Company’s employees, officers, directors and consultants eligible to participate in the 2005 Plan. As of that date, there were approximately 3,195,280 shares of our common stock subject to outstanding awards and approximately 3,677,686 shares of our common stock were reserved and available for future awards under the 2005 Plan. If the Qualified Business Criteria are not re-approved by the shareholders at the annual meeting, any Awards (other than options or stock appreciation rights) granted under the 2005 Plan after the annual meeting will not qualify for the performance-based compensation deduction from Code Section 162(m) and may, therefore, result in the non-deductibility of some or all of such Awards.

Performance Goals. All options and stock appreciation rights granted under the 2005 Plan will be exempt from the $1,000,000 deduction limit imposed by Code Section 162(m). The Compensation Committee may

11

designate any other award granted under the 2005 Plan as a qualified performance-based award in order to make the award fully deductible without regard to the $1,000,000 deduction limit imposed by Code Section 162(m). If an award is so designated, the Compensation Committee must establish objectively determinable performance goals for the award based on one or more of the following business criteria, which may be expressed in terms of company-wide objectives or in terms of objectives that relate to the performance of an affiliate or a division, region, department or function within the Company or an affiliate:

Revenue

Sales

Profit (net profit, gross profit, operating profit, economic profit, profit margins or other corporate profit measures)

Earnings (EBIT, EBITDA, earnings per share, or other corporate earnings measures)

Net income (before or after taxes, operating income or other income measures)

Cash (cash flow, cash generation or other cash measures)

Stock price or performance

Total shareholder return (stock price appreciation plus reinvested dividends)

Return on Equity

Return on assets

Return on Investment

Market share

Improvements in capital structure

Expenses (expense management, expense ratio, expense efficiency ratios or other expense measures)

Business expansion or consolidation (acquisitions and divestitures)

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS RE-APPROVE AT THE ANNUAL MEETING THE FOREGOING LIST OF BUSINESS CRITERIA FOR THE PURPOSES OF FUTURE PERFORMANCE-BASED AWARDS THAT ARE INTENDED TO BE FULLY DEDUCTIBLE UNDER CODE SECTION 162(M).

12

CERTAIN INFORMATION CONCERNING THE EXECUTIVE OFFICERS

The following table sets forth the names of our executive officers, their ages, their positions with the Company, and their principal occupations and employers for at least the past five years. There are no arrangements or understandings between any of our executive officers and any other person pursuant to which any of them was elected an officer, other than arrangements or understandings with our officers acting solely in their capacities as such. Our executive officers serve at the pleasure of our Board of Directors.

Name | Age | Current Position(s) | Position with Global Payments and Other Principal Business Affiliations | |||

Paul R. Garcia | Chairman of the Board of Directors

| Chairman of the Board of Directors | ||||

James G. Kelly | President and Chief Operating Officer (since November 2008); Senior Executive Vice President | |||||

| Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Financial Officer (since | ||||

| of CheckFree Corporation (July 2000 to December 2007); Senior Vice President, Finance and | |||||

13

Joseph C. Hyde | 35 | President - International | ||||

Suellyn P. Tornay | Executive Vice President and General Counsel | Executive Vice President (since June 2004) and General Counsel for the Company (since February 2001); Interim General Counsel for National Data Corporation (1999–2001); Group General Counsel, eCommerce Division of National Data Corporation (1996–1999); Senior Attorney, eCommerce Division of National Data Corporation (1987–1995); Associate at Powell, Goldstein, Frazer, & Murphy (1985–1987). | ||||

Carl J. Williams | Advisor – Business Development and International Operations (since November 2008); President–World-Wide Payment Processing of | |||||

Morgan M. Schuessler | Executive Vice President | Executive Vice President and Chief Administrative Officer (since November 2008); Executive Vice President, Human Resources and Corporate Communications of | ||||

14

Daniel C. O’Keefe | 43 | Senior Vice President and Chief Accounting Officer | Senior Vice President and Chief Accounting Officer of the Company (since August 2009); Vice President, Accounting Policy of the Company (April 2009-August 2009); Vice President and Chief Accounting Officer of Ocwen Financial Corporation (November 2006-April 2009) (4); Vice President, Business Management of RBS Lynk (February 2005-October 2006) (5); Assistant Controller, External Reporting of Beazer Homes USA, Inc. (November 2002-February 2005) (6). | |||

| (1) |

| (2) |

| (3) | A global payments network and travel company. |

| (4) | Business process outsourcing provider to the financial services industry, specializing in loan servicing, mortgage fulfillment and receivables management services. |

14

| (5) | Provider of payment processing services. |

| (6) | Residential homebuilder. |

15

COMMON STOCK OWNERSHIP OF MANAGEMENT

The following table sets forth information as of August 19, 2008,July 23, 2009, with respect to the beneficial ownership of the Company’s Common Stock by the nominees to the Board, by the directors of the Company, by each of the persons named in the Summary Compensation Table, and by the 1516 persons, as a group, who were directors and/or executive officers of the Company on August 19, 2008.July 23, 2009.

Except as explained in the footnotes below, the named persons have sole voting and investment power with regard to the shares shown as beneficially owned by them.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (1) | Amount and Nature of Beneficial Ownership | Percent of Class (1) | ||||||||||

Paul R. Garcia | 1,271,675 | (2) | 1.5 | % | 1,348,004 | (2) | 1.7 | % | ||||||

Edwin H. Burba, Jr. | 51,549 | (3) | * | 52,487 | (3) | * | ||||||||

Alex W. Hart | 43,593 | (4) | * | 44,621 | (4) | * | ||||||||

William I Jacobs | 74,908 | (5) | * | 76,507 | (5) | * | ||||||||

Raymond L. Killian, Jr. | 23,047 | (6) | * | 24,075 | (6) | * | ||||||||

Ruth Ann Marshall | 5,235 | (7) | * | 6,263 | (7) | * | ||||||||

Alan M. Silberstein | 23,047 | (8) | * | 24,075 | (8) | * | ||||||||

Michael W. Trapp | 24,511 | (9) | * | 25,539 | (9) | * | ||||||||

Gerald J. Wilkins | 24,141 | (10) | * | 18,585 | (10) | * | ||||||||

David E. Mangum | 15,066 | (11) | * | |||||||||||

Joseph C. Hyde | 117,289 | (11) | * | 120,854 | (12) | * | ||||||||

James G. Kelly | 526,676 | (12) | * | 492,134 | (13) | * | ||||||||

Carl J. Williams | 107,713 | (13) | * | 123,295 | (14) | * | ||||||||

Suellyn P. Tornay | 85,469 | (14) | * | 88,148 | (15) | * | ||||||||

All Directors and Executive Officers as a group | 2,412,031 | (15) | 2.9 | % | 2,503,990 | (16) | 3.0 | % | ||||||

| * | Less than one percent. |

| (1) | The percentage calculations are based on |

| (2) | This amount includes |

| (3) | This amount includes options to purchase 47,635 shares which are currently exercisable or will become exercisable within 60 days. This amount includes |

| (4) | This amount includes options to purchase 31,895 shares which are currently exercisable or will become exercisable within 60 days. |

| (5) | This amount includes options to purchase 47,635 shares which are currently exercisable or will become exercisable within 60 days. |

| (6) | This amount includes options to purchase 18,513 shares which are currently exercisable or will become exercisable within 60 days. |

| (7) | This amount includes options to purchase |

| (8) | This amount includes options to purchase 18,513 shares which are currently exercisable or will become exercisable within 60 days. |

| (9) | This amount includes options to purchase 19,739 shares which are currently exercisable or will become exercisable within 60 days. This amount includes |

| (10) | This amount includes options to purchase |

1516

| (11) | This amount includes |

| (12) | This amount includes 13,305 shares of restricted stock over which Mr. Hyde has sole voting power and options to purchase |

| (13) | This amount includes |

| (14) | This amount includes |

| (15) | This amount includes |

| (16) | This amount includes 1,868,975 options which are currently exercisable or will become exercisable within 60 days. |

1617

COMMON STOCK OWNERSHIP BY CERTAIN OTHER PERSONS

The following table sets forth information as of the date indicated with respect to the only persons who are known by the Company to be the beneficial owners of more than 5% of the outstanding shares of Common Stock.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class on December 31, 2007 based on 79,484,328 shares outstanding | Amount and Nature of Beneficial Ownership | Percent of Class on December 31, 2008 based on 80,195,000 shares outstanding | ||||||

T. Rowe Price Associates, Inc. (1) 100 East Pratt Street Baltimore, Maryland 21202 | 9,426,312 | 11.9 | % | 10,197,912 | 12.7 | % | ||||

EARNEST Partners, LLC (2) 1180 Peachtree Street Suite 2300 Atlanta, Georgia 30309 | 5,611,517 | 7.1 | % | 4,808,321 | 6.0 | % | ||||

TimesSquare Capital Management, LLC (3) 1177 Avenue of the Americas 39th Floor New York, NY 10036 | 4,935,590 | 6.2 | % | |||||||

Capital Research Global Investors (4) 333 South Hope Street Los Angeles, CA 90071 | 3,950,000 | 5 | % | |||||||

Capital Research Global Investors (3) 333 South Hope Street Los Angeles, CA 90071 | 4,795,000 | 6.0 | % | |||||||

TimesSquare Capital Management, LLC (4) 1177 Avenue of the Americas 39th Floor New York, NY 10036 | 4,119,160 | 5.1 | % | |||||||

| (1) | This information is contained in a Schedule 13G filed by T. Rowe Price Associates, Inc. and T. Rowe Price Mid-Cap Growth Fund, Inc. with the Securities and Exchange Commission on February |

| (2) | This information is contained in a Schedule 13G filed by EARNEST Partners, LLC with the Securities and Exchange Commission on |

| (3) |

| This information is contained in a Schedule 13G filed by Capital Research Global Investors with the Securities and Exchange Commission on February |

| (4) | This information is contained in a Schedule 13G filed by TimesSquare Capital Management, LLC with the Securities and Exchange Commission on February 9, 2009. TimesSquare Capital Management, LLC reports sole dispositive power of all shares listed above and sole voting power for 3,459,500 shares. |

17

18

COMPENSATION AND OTHER BENEFITS:

COMPENSATION DISCUSSION AND ANALYSIS

2009 Compensation Highlights

Fiscal year 2009 was a successful year for Global Payments; however the deterioration in the worldwide economy presented its challenges. Our executive compensation was impacted by these challenges, as well as by our stock price.

Fiscal year 2009 base salary decisions reflected in this proxy statement were made in July 2008, before the stock market downturn, and reflect market factors at that time. The Named Executive Officers will not receive a salary increase for fiscal year 2010.

Fiscal year 2009 bonus payouts reflect healthy growth in our earnings and revenues, as defined to exclude the impact of restructuring, other non-recurring charges, and the impact of changes in foreign currency.

The earned level of fiscal year 2009 performance-based restricted stock awards reflects performance below target, largely as a result of the impact of changes in foreign currency. The executives received only 37% of their targeted value.

Fiscal year 2009 stock option grants (with the exception of the new hire grant made to Mr. Mangum) were made at $44.29 and will create no value to executives unless the stock price exceeds that level. The stock price at the end of the first business day after May 31, 2009 was $36.61.

Following is additional detail regarding our executive pay program.

| A. | Introduction |

In the paragraphs that follow, we will giveprovide an overview and analysis of our compensation program and policies, the material compensation decisions we have made under those programs and policies, and the material factors that we considered in making those decisions. Following this section you will findis a series of tables containing specific information about the compensation earned or paid in fiscal year 20082009 to the following individuals, to whom we refer as our “Named Executive Officers” or “NEOs” for the purposes of this proxy.proxy statement.

Paul R. Garcia—Chairman President, and Chief Executive Officer

Joseph C. Hyde—David E. Mangum—Executive Vice President and Chief Financial Officer (hired November 1, 2008)

Joseph C. Hyde—President—International

James G. Kelly—Senior Executive Vice President and Chief Operating Officer

Carl J. Williams—President—World-wide Payment ProcessingAdvisor—Business Development and International Operations

Suellyn P. Tornay—Executive Vice President and General Counsel

The discussion below is intended to help you understand the detailed information provided in those tables and put that information into context within our overall compensation program.

| B. | Objectives of Compensation Policies |

We design our compensation program with a view to retaining and attracting executive leadership of a caliber and level of experience necessary to effectively manage our complex, growth-oriented, and global businesses. Our objective is to have a compensation program that will allow us to:

Support the financial and business objectives of the organizationorganization;

Attract, motivate, and retain highly qualified executivesexecutives;

Create an environment where high performance is expected and rewardedrewarded;

19

Deliver an externally competitive total compensation structurestructure;

Allow flexibility in the design and administration to support aggressive growth initiativesinitiatives; and

Align the interests of our executives with our shareholdersshareholders.

In order to do this effectively, our program must:

Provide our executives with total compensation opportunities at levels that are competitive for comparable positionspositions;

Provide variable, at-risk incentive awards opportunities that are only payable if specific goals are achievedachieved;

Provide significant upside opportunities for exceptional performanceperformance; and

Closely alignAlign our executives’ interests with those of our shareholders by making stock-based incentives a core element of our executives’ compensationcompensation.

Opportunities for at-risk compensation are market-based, while actual payments are performance-based. The target levels of the program are based on competitive market data. The amount that is actually paid to an executive considers company and individual performance. This policy results in actual compensation that is appropriate given our level of performance.

18

| C. | Role of the Independent Compensation Consultant |

The Compensation Committee retained an independent compensation consultant from Hewitt Associates. The consultant takes guidance from and reports directly to the Compensation Committee. She advises the Compensation Committee on current and future trends and issues in executive compensation and on the competitiveness of the compensation structure and levels of our executives, including the Named Executive Officers. At the request of the Committee and to provide context for the Committee’s compensation decisions made for fiscal year 2008,2009, Hewitt performed the following services for the Committee late in fiscal year 2007:2008. Because Mr. Mangum was hired during fiscal year 2009, we used the Hewitt market data for the CFO position provided in late fiscal year 2008 to make the compensation recommendations which were approved by the Committee.

Conducted a market review and analysis for the Named Executive Officers and for other executives whose compensation is determined by the Compensation Committee to determine whether their total targeted compensation levels were competitive with positions of a similar scope in similarly sized companies;

Conducted pay and performance relationship analyses to appraiseevaluate the correlation of Company performance and pay levels to thatthose of the peer group companies;

Reviewed and provided recommendations on the executives’ annualCompared our long term incentive plan design which compared it to those of our peer group and general industry, providing additional transparency to the Compensation Committee and ensuring overallassess plan competitiveness within the market;

Reviewed and provided recommendations on the long term incentive plan design to better align the expense to the company with the perceived value to the employee and add an additional shareholder component to the plan with the introduction of stock ownership guidelines;our market for talent;

Conducted a dilutionan analysis of the prevalence of perquisites and update forretirement income benefits among the Compensation Committee, which compares the Company’s share usage to that ofcompanies in our peer group and measures the impact to shareholder value through the effect of equity programs on the ownership of current shareholders;group;

Conducted a market reviewan analysis compared to the peer group of existing share dilution in order to measure any impacts to shareholder voting power and analysis for the Company’s directors to determine the level of competitiveness in director pay;earnings per share based ( or EPS) on stock outstanding;

Prepared tally sheets on the Named Executive Officers, except for Mr. Garcia and Mr. KellyMangum, for the Compensation Committee to review the total wealth accumulated during the executives’ tenure with the Company and the impact to the Company in the event of a termination or change in control; and

Attended a Committee meeting to discuss these items with the Committee.

| D. | Market Data |

We consider the compensation levels, programs, and practices of certain other companies to assist us in setting our executive compensation so that it is market competitive. For fiscal year 2008,2009, the following peer group was utilized for this purpose. All of the companies in the peer group are in the transaction processing or the data services business. We compete for talent with several of these peer companies.

20

Acxiom Corp

| Equifax Euronet Worldwide Fair Isaac

| Heartland Payment Systems Moneygram International Paychex

Total System Services |

The Compensation Committee annually reviews and updates the list of companies comprising the peer group to ensure we have the rightan appropriate marketplace focus.

19

Before the Compensation Committee met in executive session to set fiscal year 20082009 compensation, the independent consultant collected and analyzed comprehensive market data for its use. The consultant presented size-adjusted market values for base salary, short term incentives, and long term incentives, using peer group proxy data as the primary data source and supplementing it as necessary with general industry information from Hewitt’s proprietary executive compensation database. The results of the analysis were that fiscal year 20072008 total compensation for our Named Executive Officers (at target performance levels) fell within four percentage points ofbelow the size-adjusted 50th percentileaverage of the market for similar jobs.jobs, except for Mr. Williams, whose fiscal year 2008 total compensation at target performance level was at the market average.

| E. | How Decisions Are Made and the Role of Executive Officers |

Our Chief Executive Officer (Paul R. Garcia), with the assistance of our human resources department, develops compensation recommendations for the executive officers who report directly to him (including the Named Executive Officers) based upon market data supplied by the independent consultant, the Company’s performance relative to goals approved by the Compensation Committee, individual performance versus personal objectives, and other individual contributions to the Company’s performance. Mr. Garcia is not involved in determining his own compensation. The Compensation Committee reviews and approves all compensation elements for the Named Executive Officers and sets the compensation of the CEO, after receiving advice from the independent consultant.

| F. | Overview of Executive Compensation Program Elements |

The following elements comprise our compensation program for executives:

base salary;

short term incentives;

long term incentives;

retirement benefits; and

other benefits, such as certain limited perquisites.

To provide flexibility in using the different elements of compensation from year-to-year,year to year, the Compensation Committee does not have a policy with regard to the allocation among the major elements of compensation, including base salary, short term incentives, and long term incentives. However, ourincentives but tends to approximate the mix of pay inherent in the market data. Our fiscal year 20082009 decisions for each of our Named Executive Officers resulted in total target compensation falling within fifteen percent of the median of the market. The following executive pay at target levels was set by the Compensation Committee for fiscal year 2008:2009:

Name | Base Salary ($) | Cash Incentive ($) | Performance Shares (#) | Stock Options (#) | ||||

Paul R. Garcia | 850,000 | 680,000 | 58,651 | 41,544 | ||||

Joseph C. Hyde | 365,000 | 200,750 | 12,513 | 8,864 | ||||

James G. Kelly | 500,000 | 300,000 | 19,552 | 13,849 | ||||

Carl J. Williams | 450,000 | 247,500 | 19,552 | 13,849 | ||||

Suellyn P. Tornay | 312,000 | 156,000 | 9,385 | 6,648 |

21

Name | Base Salary ($) | Cash Incentive ($) | Performance Units (#) | Stock Options (#) | |||||||||

Paul R. Garcia | $ | 950,000 | $ | 950,000 | 52,684 | 39,513 | |||||||

David E. Mangum | $ | 400,000 | $ | 280,000 | N/A | (2) | N/A | (2) | |||||

Joseph C. Hyde | $ | 400,000 | $ | 280,000 | 12,513 | 9,385 | |||||||

James G. Kelly | $ | 600,000 | (1) | $ | 450,000 | 17,217 | 12,913 | ||||||

Carl J. Williams | $ | 500,000 | $ | 350,000 | 14,582 | 10,937 | |||||||

Suellyn P. Tornay | $ | 350,000 | $ | 192,500 | 8,656 | 6,492 | |||||||

| (1) | Mr. Kelly’s base salary was increased from $550,000 to $600,000 in November 2008 upon his promotion to President and COO. |

| (2) | Mr. Mangum’s cash compensation was determined by the Committee using the peer group market analysis conducted by Hewitt. Mr. Mangum did not participate in the fiscal year 2009 long-term incentive program and did not receive performance shares; however, he did receive 20,000 stock options and 15,000 time-based restricted stock shares upon his hire in November 2008. The date of his grant was November 3, 2008, and the stock price (which is the grant price of the options) was $42.03 a share. |

When the Committee established the EPS goals for the annual performance and performance unit plans that are described throughout this narrative, it calculated the relationship between the additional earnings represented and the incremental short-term incentive and performance unit payouts that would be owed as a result of the executives reaching their goals. This maintains an equilibrium between shareholder reward and executive reward between the target and maximum goal levels.

(1) Base Salary. Base salary provides our executive officers with a level of compensation consistent with their skills, responsibilities, experience and performance in relation to comparable positions in the marketplace. Base salary is the one fixed component of our executives’ compensation. The Compensation Committee reviews the base salaries of our executive officers annually. Base salary increases determined at the beginning of fiscal year 2009 for all the Named Executive Officers were in a 4%10% to 12% range rounded to the nearest whole percentage. Mr. Kelly received a second salary increase of 9% range.upon his promotion to President and COO in November 2008, which represented a full year salary increase of 20% when combined with his initial increase at the start of fiscal year 2009.

20

Recommendations for fiscal year 20082009 were approved at the JuneJuly 2008 Compensation Committee meeting. The Committee met in executive session to discuss the increase for Mr. Garcia and the other executives. Base salary increases for the executives are effective on June 1 of each year.

(2) Short Term IncentivesIncentives.. We provide our Named Executive Officers with short term incentive opportunities to motivate and reward them for the achievement of the Company’s defined business goals and objectives and to reward individual performance. Our short term incentive program includes an annual performance plan and our commitment and accountability program.

(a) Annual Performance Plan.The annual performance plan provides an opportunity for executives to earn variable at-risk cash compensation. Each executive is assigned a target award opportunity, expressed as a percentage of base salary. The fiscal year 20072008 target opportunities were lower than the market levels provided by the consultant. Since all data on the peer group companies was not available in late fiscal year 2007 (because some peer companies had not yet filed proxy statements) the independent consultant also reviewed target opportunities using general industry market data. Given these combined results, the target bonuses for our executives were 5% to 10% lower than the market levels provided by the consultant. Based on the review of the data, the Compensation Committee increased and set each executive’s target bonus opportunities for fiscal year 20082009 as follows: Mr. Garcia—$680,000950,000 or 80%100% of his base salary, which was increased from 70%80% of his base salary in fiscal year 2007;2008; Mr. Hyde—Mangum—$200,750280,000 or 55%70% of his base salary, which was increased from 50% ofdetermined upon his base salaryhire in fiscal year 2007;November 2008; Mr. Kelly—Hyde—$300,000280,000 or 60%70% of his base salary, which was increased from 55% of his base salary in fiscal year 2007;2008; Mr. Williams—Kelly—$247,500450,000 or 55%75% of his base salary, which was increased from 50%60% of his base salary in fiscal year 2007;2008; Mr. Williams—$350,000 or 70% of his base salary, which was increased from 55% of his base salary in fiscal year 2008; and Ms. Tornay—$156,000192,500 or 50%55% of her base salary, which was increased from 45%50% of her base salary in fiscal year 2007.2008.

22

For fiscal year 2008,2009, there were three weighted components of the annual performance plan. There were two Company objectives, which included diluted earnings per share (EPS) and revenue, goals, and a set of individual objectives that varied from person to person. The rationale for using each component in the plan is outlined in the following table:

Metric | Definition | Rationale for Use | ||

| EPS | GAAP diluted earnings per share, excluding the impact of restructuring and other non-recurring charges and the impact of changes in foreign | We believe EPS most closely aligns the performance of executives to the interests of shareholders, given that it is the primary metric we use to evaluate new business opportunities as well as the performance of existing | ||

| Revenue | GAAP revenue, excluding the impact of restructuring and other non-recurring charges and the impact of changes in foreign | As a growth-oriented company, we consider that revenue growth is critical to the Company’s | ||

| Individual Objectives | Objectives differ by | Individual objectives promote accountability for personal performance regarding areas under the executive’s | ||

For each executive’s fiscal year 2008 annual performance plan, the weighted components for the two Company objectives were increased and the weighted component for individual objectives was decreased from fiscal year 2007. The Compensation Committee made this decision to increase the incentive component tied to fiscal year financial objectives. Mr. Garcia’s relative weighting differed from that of the other executives because the Compensation Committee determined that a higher percentage of the CEO’s opportunity should be tied to Company performance than to his individual objectives. The table below shows the revisions made from 2007 to each executive’s annual incentive plan:

21

Name | Diluted EPS | Revenue | Individual Objectives | |||||||||||||||

| FY07 | FY08 | FY07 | FY08 | FY07 | FY08 | |||||||||||||

Paul R. Garcia | 40 | % | 50 | % | 20 | % | 30 | % | 40 | % | 20 | % | ||||||

Joseph C. Hyde | 30 | % | 40 | % | 20 | % | 30 | % | 50 | % | 30 | % | ||||||

James G. Kelly | 30 | % | 40 | % | 20 | % | 30 | % | 50 | % | 30 | % | ||||||

Carl J. Williams | 30 | % | 40 | % | 20 | % | 30 | % | 50 | % | 30 | % | ||||||

Suellyn P. Tornay | 30 | % | 40 | % | 20 | % | 30 | % | 50 | % | 30 | % | ||||||

The three parts of the annual performance plan were calculated separately. The target opportunity was allocated among the three elements based upon the table above.below.

Depending upon

Name | Diluted EPS | Revenue | Individual Objectives | ||||||

| FY09 | FY09 | FY09 | |||||||